tax act stimulus check error

You can also refer to the IRS Statement Update on Economic Impact Payments I received my tax refund via check from the IRS how will I get my stimulus payment. Disaster Tax Relief box is automatically checked and I can not uncheck it.

Stimulus Check Payments Nursing Home Residents Center For Elder Law Justice

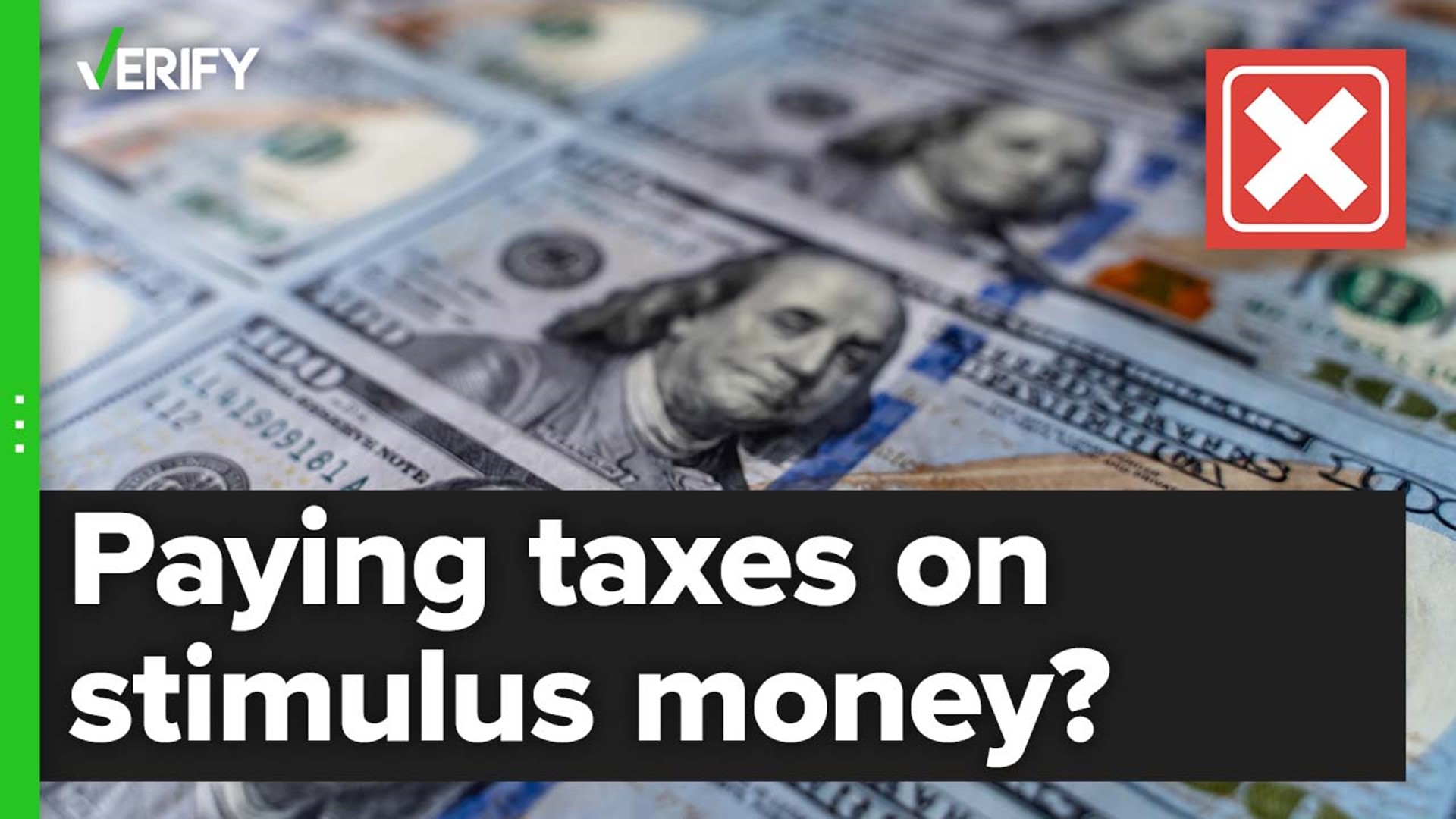

If this happens with stimulus funds or the recovery rebate credit the taxpayer owed a.

. This IRS error caused some people to not. Upon realization of this error the IRS instructed. Its a common blunder that will cause refund delays says Mark Steber CFO of Jackson Hewitt Tax Service.

On the screen titled Verify that your bank account information is correct double check your bank account information entries. We filed with Tax Act and had our fees taken out of our return. People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax return.

You are supposed to pay it back. The IRS sent some of the stimulus payments to inactive or closed bank accounts. If you made a mistake and claimed the 3rd stimulus payment do not file an amendment until you know the original return has been received and processed.

So I just filed my taxes online for free via tax act which IRSgov sent me to and one of the questions was did you receive a third stimulus for 1400 for a moment I was confused and. The IRS issued a stimulus payment based on the 2018 tax return information - that payment is an error. If you didnt get the full amount of the third Economic Impact Payment you may be.

If you suspect an error you should report this to the IRS at 800-829-1040 and take steps to resolve this. Please see Second Stimulus Payment Timing FAQs for the most up-to-date information regarding this issue. 10 2021 we announced the IRS has committed to reprocessing stimulus payments directly to our customers impacted by the IRS payment error.

If correct check the box. These updated FAQs were released to the public in Fact Sheet 2022-27 PDF April 13 2022. You should return the payment separately to your amended return.

Americans desperately need this relief and every day they go without it is a burden Sen. In the Federal section it continuously tells me the IRA 401 k Pension Plan Withdrawals section. IRS says stimulus check mistakes are among reasons for tax refund delays Families that received the payments which started in July and ended in December can file for.

However there is also a chance that you miscalculated how much money. In other words the. But the IRS states.

According to The Taxpayer Advocate Service 74 million of the errors in tax returns the IRS is contacting people about are due to overpayments involving the COVID-19 stimulus. If you make a mistake on the Line 30 amount the IRS will calculate the correct amount of the Recovery Rebate Credit make the correction to your tax. Stimulus payments erroneously sent to closed or incorrect bank accounts by the IRS are being redirected according to tax preparation companies affected by the mistake.

People who do not receive their stimulus payment by the January 15 deadline will have to wait to claim their stimulus check as a tax credit when they file their 2020 taxes. Stimulus Check Mistakes Are Now Causing Tax Refund Delays The IRS is working hard to clear its massive backlog of millions of unprocessed tax returns and correspondence. Transcript says 14 and the check my payment or whatever its called shows status not.

It is important to return the stimulus payment if you believe that you received it in error. We use chase for our bank. The IRS did incorrectly send some stimulus payments to the wrong bank account.

Up to 10 cash back To prepare for the possibility of a third stimulus payment the IRS urges filers to consider filing their 2020 tax returns as soon as possible. A check was issued in the name of a.

Your Stimulus Check May Not Come Until 2021 The Washington Post

Where S My Third Stimulus Check Turbotax Tax Tips Videos

3rd Stimulus Checks Here S What To Know As Irs Starts Sending Out 1 400 Payments Wgn Tv

American Rescue Plan What Does It Mean For You And A Third Stimulus Check Turbotax Tax Tips Videos

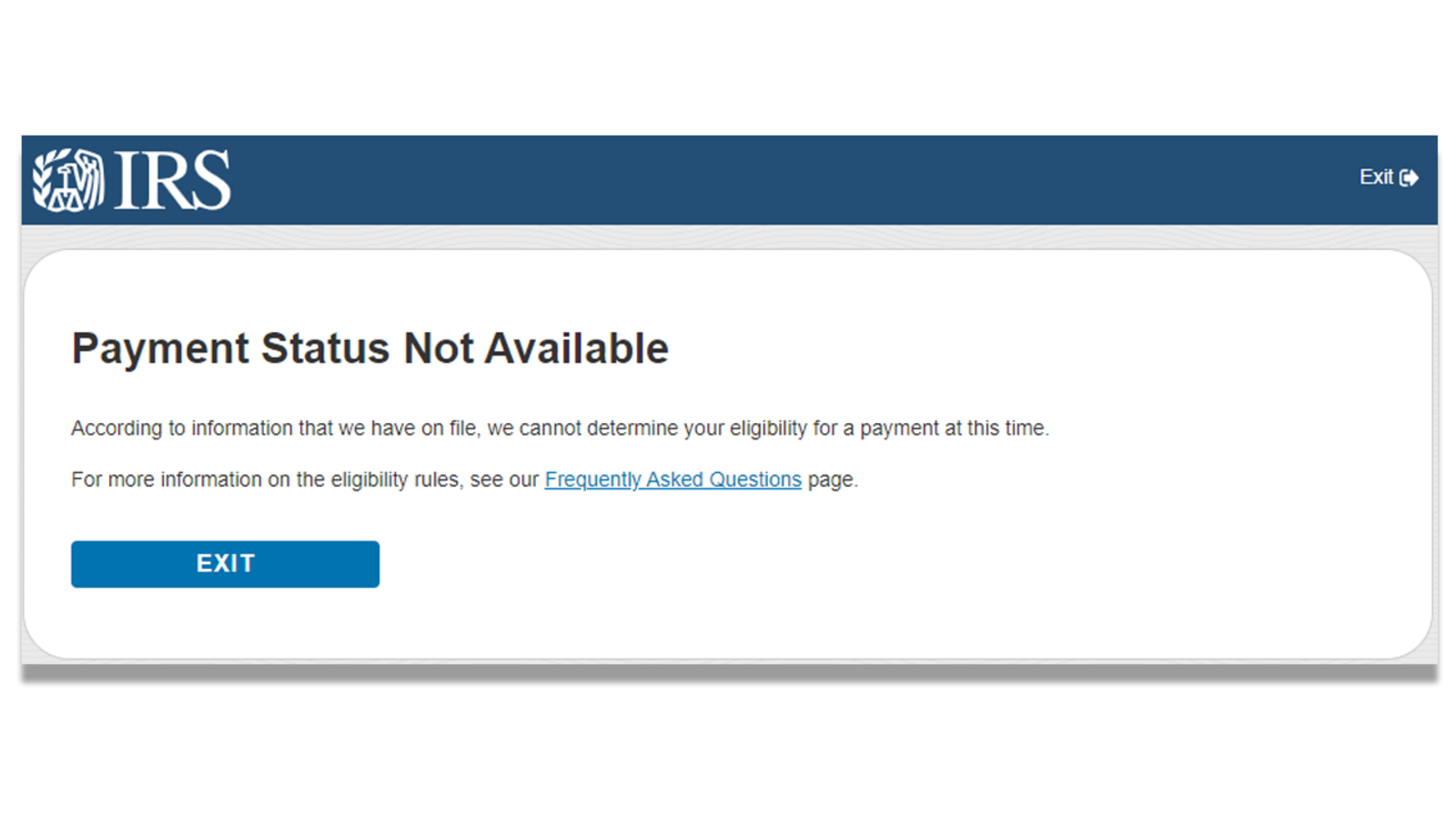

Second Stimulus Check Problems Payment Status Not Available Error On Irs Website Means Some Need To Claim 600 On 2020 Tax Returns Abc7 San Francisco

Third Stimulus Check Update How To Track 1 400 Payment Status 11alive Com

Americans Struggle To Receive Missing Stimulus Checks

Some Americans Won T Get Their Stimulus Checks Until They File Their 2020 Taxes The Washington Post

Third Stimulus Check Is Not Taxable Wusa9 Com

Stimulus Check Problems What To Do If Check Goes Into Wrong Account Irs Get My Payment Portal Shows Error Abc7 New York

Irs Stimulus Checks Frustrated Americans Left Waiting For Payments As Internal Revenue Service Sends Funds To Wrong Accounts Amid Coronavirus Pandemic Abc13 Houston

Coronavirus Stimulus Checks Sent To Millions Of Dead People Treasury Department Wants Them Back Abc7 San Francisco

U S Expats Coronavirus Stimulus Checks Top Faqs H R Block

The Irs Is Still Issuing Third Stimulus Checks We Ve Got Answers To Your Faqs Forbes Advisor

The Irs Is Still Issuing Third Stimulus Checks We Ve Got Answers To Your Faqs Forbes Advisor

The Second Stimulus Payment Is Happening Taxact Blog

Nonresident Guide To Cares Act Stimulus Checks

Irs Stimulus Check Portal Payment Status Not Available Error What Does It Mean Abc11 Raleigh Durham