how much is virginia inheritance tax

If you dont know what inheritance tax is you probably. How do you avoid inheritance tax.

Transfer On Death Tax Implications Findlaw

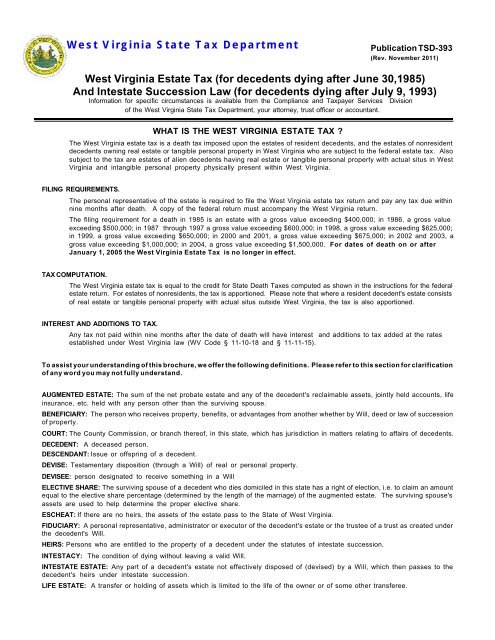

For Ohio they estimate approximately 220 million with West Virginia at just over 38 million.

. As of 2021 the six states that charge an inheritance tax are. The top estate tax rate. 15 best ways to avoid inheritance tax in 2020.

Unlike the federal government Virginia does not have an estate tax. Generally Virginia does not require an estate tax return unless there is a federal estate tax return due. 2 Give money to family members and friends.

Virginia Income Tax Calculator 2021. How much can you inherit without paying taxes in virginia. Price at Jenkins Fenstermaker PLLC by.

13 hours agoBiden to pardon all federal offenses of simple marijuana possession. If you make 70000 a year living in the region of Virginia USA you will be taxed 12100. Who has to pay.

Your average tax rate is 1198 and your marginal tax rate is. The federal estate tax is due nine months from the date of death and is currently filed. Today Virginia no longer has an estate tax or inheritance taxPrior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes.

The totals were based on an estimate of potential adults that would use the product three years post. 1- Make a gift to your partner or spouse. This chapter shall be known and may be cited as the Virginia Estate Tax Act Code 1950 58-2381.

Today Virginia no longer has an estate tax or inheritance taxPrior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40. Inheritance tax rates differ by the state.

In 2022 estates with a value of 12060000 must file a return a significantly increased upper bound compared to the 1500000 seen in 2004 and 2005. Virginia Estate Tax 581-900. 1 day agoWatch on.

If you are considering your estate plan or have recently received an inheritance and need more information contact me Anna M. This is great news for Virginia residents. But just because Virginia does not have an.

Because of this the estimated tax totals could be high or low. These states have an inheritance tax. Virginia estate tax.

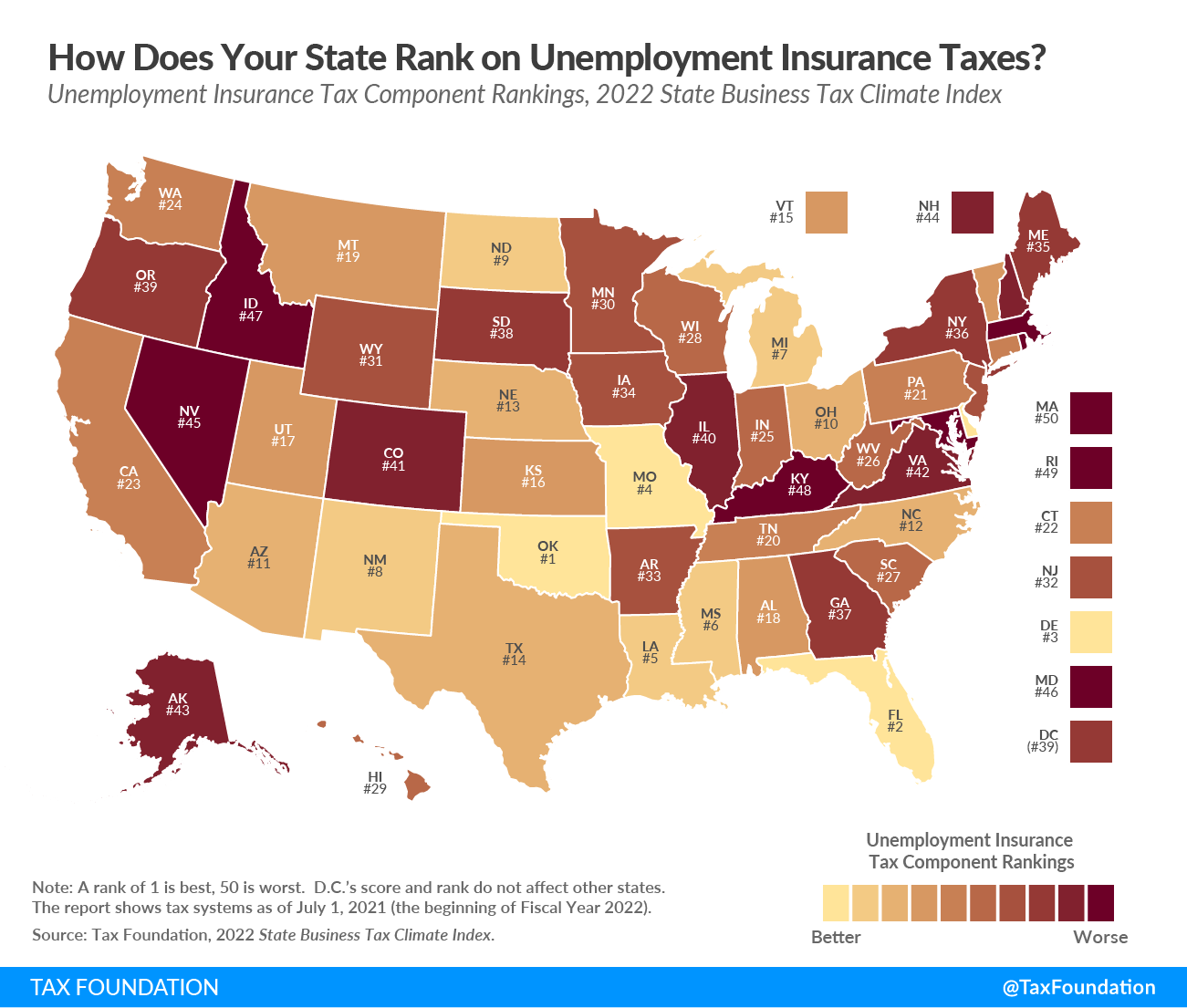

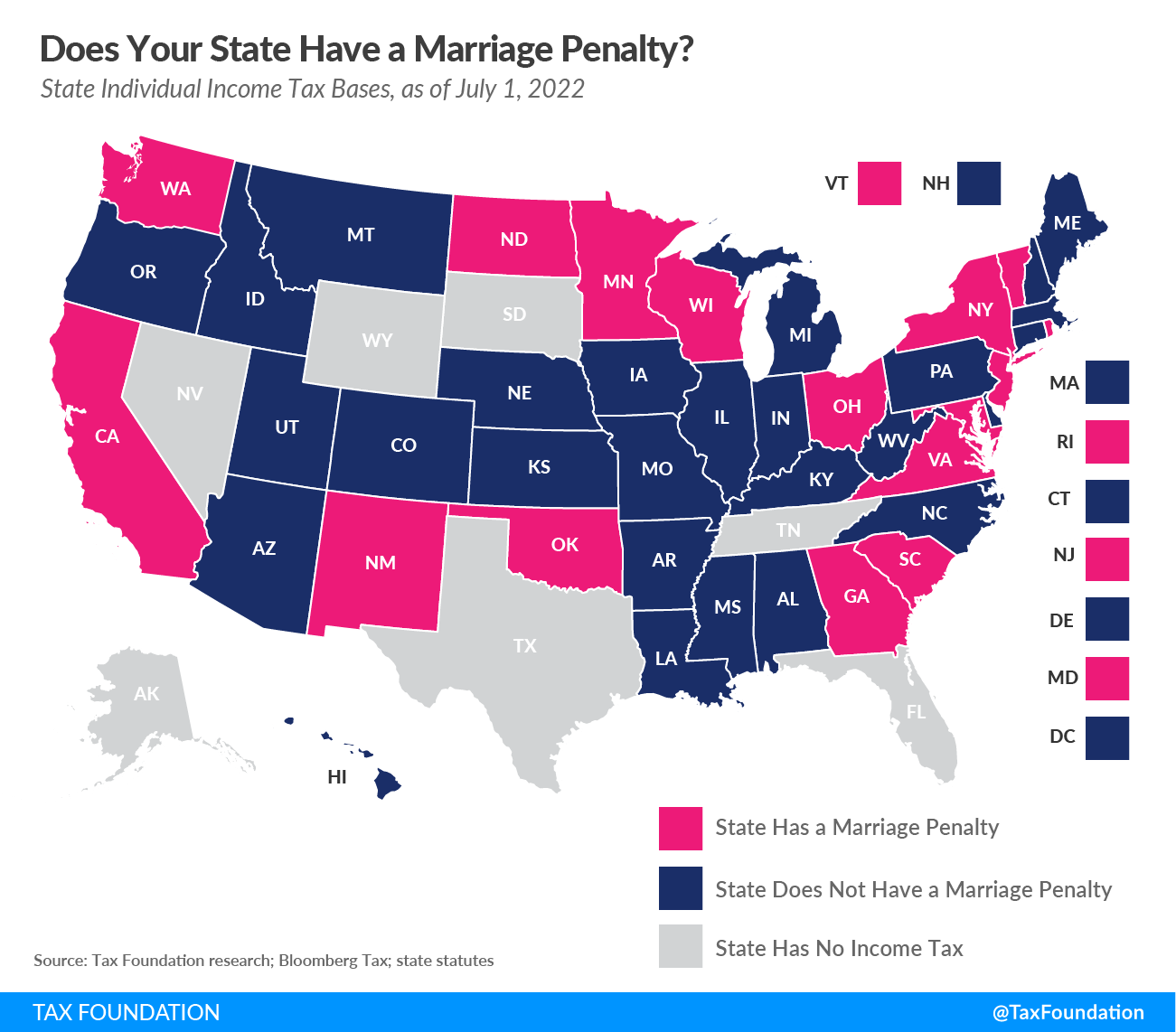

Virginia Tax Rates Rankings Virginia State Taxes Tax Foundation

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Virginia Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Inheritance Tax Who Pays Which States In 2022 Nerdwallet

New Jersey Estate Tax Changes Mccarthy Weidler Pc

Federal Estate And Missouri Inheritance Taxes Legacy Law Missouri

Probate Tax Return Pdf Fpdf Docx Virginia

Estate And Inheritance Taxes By State In 2021 The Motley Fool

What Is The West Virginia Estate Tax Publication Tsd 393

Assessing The Impact Of State Estate Taxes Revised 12 19 06

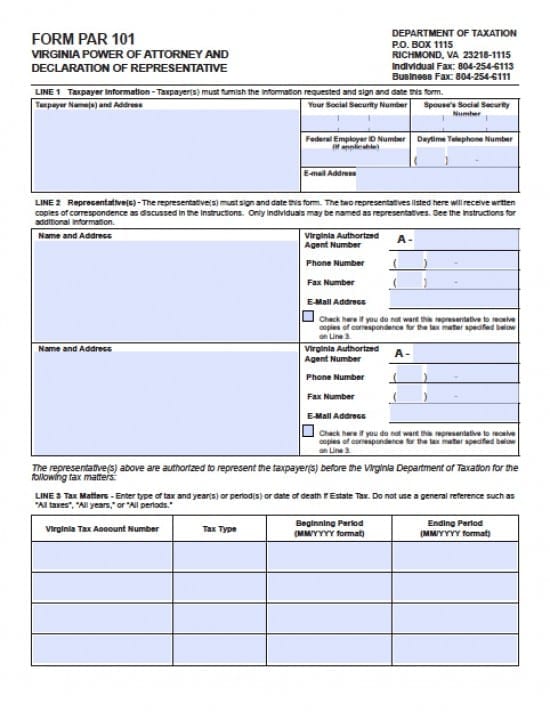

Virginia Tax Power Of Attorney Form Power Of Attorney Power Of Attorney

Free Virginia Tax Power Of Attorney Form Pdf

Virginia Inheritance Laws What You Should Know Smartasset

Estate Tax Calculator Washington Dc Maryland Virginia Lawyer Attorney Law Firm

Lynchburg Homeowners Alarmed By 2019 Real Estate Tax Assessment Wset